Smallcaps are a high-risk, high-reward stocks.

Generally, when people invest in smallcap stocks, dividend payments aren’t the first thing they think about.

One of the most compelling reasons to invest in a smallcap is that most investors are on the lookout for the next great growth company with the potential to multiply wealth.

Smallcaps are a high-risk, high-reward stocks. They have room for progress, but also possibilities for failure if things don’t go well.

Though they have the potential to give investors good returns in the short term, it’s advisable to stay invested in them for the long term to mitigate the risks.

But if you want your portfolio to earn a source of income, then smallcap dividend paying stocks are your best bet. They provide Investors a sense of security because dividends act as passive source of income.

Usually, dividends are paid out of a company’s earnings, so it’s reasonable to believe that they’re an indication of good financial health in most circumstances.

This gives confidence to investors who are considering investing in a risky financial asset while also receiving something in return.

Let’s take a look at top smallcap companies with a good dividend track record and over 4.5% in dividend yield.

1. PTC India

PTC India, formerly Power Trading Corporation of India, is an Indian company that provides power trading solutions, cross border power trading, and consultancy services.

The company also has operations in Nepal, Bhutan, and Bangladesh.

PTC India’s subsidiaries, PTC India Financial Services and PTC Energy, provide financial assistance for companies in the power sector and run renewable energy projects, respectively.

Recently, PTC India Financial Services made headlines that three independent directors – Kamlesh Shivji Vikamsey, Santosh B Nayar, and Thomas Mathew – had resigned en masse from the board citing lapses in corporate governance and compliance. An independent director of PTC India, Rakesh Kacker, also resigned.

PTC India on Friday said its board has directed its risk management committee to look into corporate governance issues at PFS.

In the September 2022 quarter, PTC India posted a marginal rise of about 1% in consolidated net profit at Rs 2 bn against Rs 1.9 bn in the year-ago period.

During the quarter, the company’s board declared an interim dividend of Rs 2 per equity share having face value of Rs 10 each for financial year 2021-22.

Moreover, the stock is providing a good dividend yield of 7.9% and has been maintaining a healthy dividend payout ratio of 48.5%.

For the year ended March 2021, PTC India has declared dividend of 75% on its face value, which amounts to Rs 7.5 per share.

Over the last one year, the counter’s share price has moved up from Rs 59.6 to Rs 94.5, registering a gain of Rs 35 or around 58.7%.

2. SJVN

Satluj Jal Vidyut Nigam (SJVN) is an Indian public sector undertaking in the business of electricity generation. The company is also in the business of hydroelectric power generation and transmission.

It was incorporated in 1988 as Nathpa Jhakri Power Corporation, a joint venture between government of India and government of Himachal Pradesh.

Government of India holds around 59.92% stake in the company, while the governor of Himachal Pradesh holds 26.85%.

Presently, the company has 5 operation electricity projects across India with a total capacity of 2,015 megawatt (MW).

It has stable revenue stream through long term power purchase agreements (PPAs) with state electricity boards and distribution Licensees.

Top clients of the firm include – government of Himachal Pradesh, U.P Power Corp, PDD, J&K, Punjab State Power Corp and Bihar.

Meanwhile, the company has a vision to increase its electricity generation capacity to 5,000 MW by 2023, 12,000 MW by 2030 and 25,000 MW by 2040.

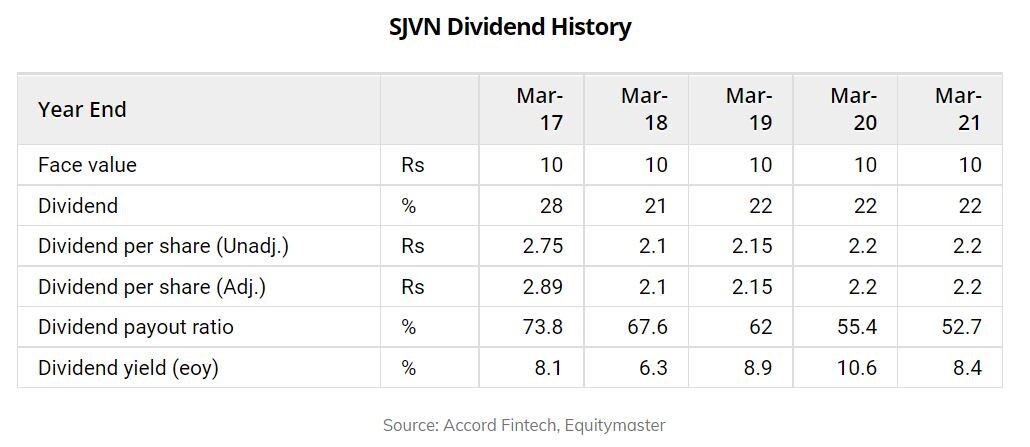

The company has a good dividend track report. It has consistently declared dividends for the last 10 years. Sine 2010, the company has announced 19 dividends.

In the past 12 months, SJVN has declared a dividend of Rs 2.2 per share.

At the current share price of Rs 30.05, this results in a dividend yield of 7.3%.

3. Hudco

The Housing and Urban Development Corporation (HUDCO) is a government corporation under the ownership of Ministry of Housing and Urban Affairs (MoHUA), Government of India.

The primary activity of HUDCO is the financing of housing and urban development projects in the country.

Ministry of Housing and Urban Affairs is the largest shareholder in the company, having a 61.08% share. 20.73% share is with the Ministry of Rural Development while the public holding is 18.19%.

HUDCO paid a total dividend of Rs 4.4 bn to its shareholders for the financial year 2020-21.

HUDCO declared dividend of 22% on its face value, which amounts to Rs 2.18 per share for the fiscal 2020-21.

At the current price of Rs 41.1, this translates to a dividend yield of 5.3%.

For the September 2022 quarter, HUDCO has declared an equity dividend of 14.25% amounting to Rs 1.43 per share.

However, over the last one year, the company’s share price is under pressure and has given negative returns of 5% to its shareholders on the back of poor financial performance.

The public sector entity posted a 19% year on year (YoY) fall in consolidated net profit to Rs 3.7 bn in the July-September 2022 quarter compared to Rs 4.6 bn in the same period last year.

Currently, the company commands a market cap of Rs 8.2 bn.

4. Rites

Rail India Technical and Economic Service, abbreviated as RITES, is under the ownership of Indian Railways, Ministry of Railways, Government of India.

RITES is engaged in the business of export sales, consultancy, inspection fee, services for turnkey construction projects.

The company’s initial charter was to provide consultancy services in rail transport management to operators in India and abroad.

However, it later diversified into planning and consulting services for other infrastructure, including airports, ports, highways, and urban planning.

Majority of RITES shares are held by government of India. The President of India holds around 72.2% stake in the firm.

On the other side, the Life Insurance Corporation of India (LIC), which is preparing for an IPO, owns roughly 8.15% of the company.

RITES posted about 32% rise in consolidated profit after tax (PAT) at Rs 1.7 bn for September quarter 2021-22. In the year ago period, the PAT was at Rs 1.3 bn.

Moreover, the company is almost debt free.

The board of the firm declared a second interim dividend of Rs 4 per share amounting to Rs 960 m for financial year 2021-22.

In the year ago period, RITES has declared dividend of 130% on its face value, which amounts to Rs 13 per share.

This results in a dividend yield of 4.8%. Its dividend payout ratio for the same period stands at 70.5%.

5. Cochin Shipyard

Cochin Shipyard (CSL) is the largest shipbuilding and maintenance facility in India. It is part of a line of maritime-related facilities in the port-city of Kochi, India.

Of the services provided by the shipyard are building platform supply vessels and double-hulled oil tankers. Presently it is building the first indigenous aircraft carriers for the Indian Navy, the INS Vikrant.

The company enjoys a Miniratna status.

Cochin Shipyard is India’s first Greenfield shipbuilding yard. It is only shipyard in India with a ship building capacity upto 1.1 lakh deadweight tonnage (DWT) and which can repair ships upto 1.3 lakh DWT. It is the only yard which can repair air defence ships.

The company has reputed clientele in domestic markets includes Indian Navy, Indian Coast guard, Shipping corporation of India. Its international clients list consists of National Petroleum Construction Company (Abu Dhabi), The Clipper Group (Bahamas), Vroon offshore (Netherlands), and SIGBA AS (Norway).

According to the shareholding pattern, majority of the stake in Cochin Shipyard is held by the government of India. It holds around 72.86% in the company.

The firm has a solid dividend track record. It has paid dividends on a steady basis for the past five years.

For the year ending March 2021 Cochin Shipyard has declared an equity dividend of 155% amounting to Rs 15.5 per share. At the current share price of Rs 343.4 this results in a dividend yield of 4.5%.

Last year in November 2021, the company announced dividend of Rs 6 apiece to its shareholders.

Why you should invest in dividend paying stocks

Investing in dividend yield stocks is one of the ways of creating wealth and receiving a steady stream of income.

Dividend-paying stocks allow investors to profit in two ways: stock price appreciation and payouts made by the company.

Every individual invests in several types of assets, so the risks associated with each is also different.

Basically, investing in dividend paying stocks is a suitable option for those people who want a stable source of income and who want to stay away from stock price volatility.

Also, the benefit of buying dividend stocks is that the uncertainty of returns becomes low because the company pays a dividend at regular intervals.

But before picking such stock in the hope of earning dividends, one should make it a point to go through its financial statements, look at its dividend payment history and check out its market reputation.

Also, you can shortlist dividend paying stocks in just a few seconds using Equitymaster’s powerful stock screener. Not just powerful, it’s also flexible, allowing you to run your own custom queries.

Speaking of dividend stocks, smallcap analyst at Equitymaster, Richa Agarwal, recently recorded a video exploring the concept of dividend investing.

Happy Investing!

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

(This article is syndicated from Equitymaster.com)

(This story has not been edited by NDTV staff and is auto-generated from a syndicated feed.)